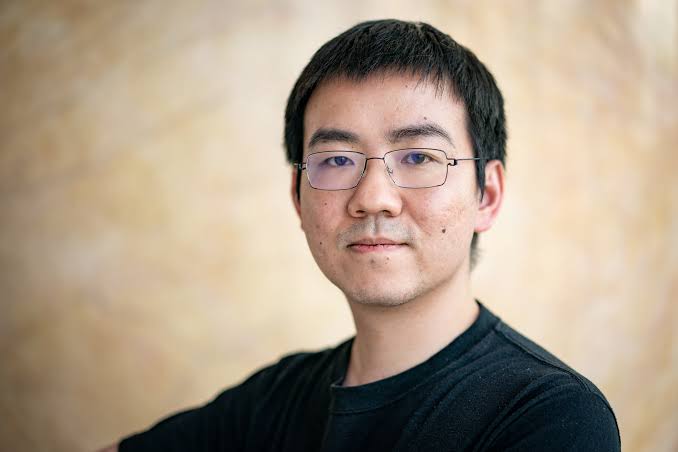

Billionaire crypto pioneer Jihan Wu Says market will grow to tens of trillions of follars – Cryptocurrencies were born to be volatile, says Jihan Wu, but their growth over the long term will far outweigh their price fluctuations. “Even if 95% of today’s coins lose all their value and disappear, the remaining 5% will grow massively,” he says.

Wu’s optimism is borne of his experience. He discovered bitcoin and recognized its early promise more than a decade ago, when he saw it being used to buy computer hardware and IT services in online forums like Bitcointalk.org. But to break out of its niche market and gain wider acceptance, bitcoin would need far more infrastructure to support it. So, Wu began working on a solution that would play a vital role in bitcoin’s development.

In 2013, Wu teamed up with Micree Ketuan Zhan to launch Bitmain Technologies, a supplier of specialized hardware known as mining rigs which are designed for the single task of adding transactions to bitcoin’s blockchain. The people who own the hardware earn, or mine, new bitcoins by making their processing power available to the network.

As bitcoin’s price rose over the years, Bitmain’s mining rigs became a runaway success, and it turned both Wu and Zhan into billionaires. By 2018, Bitmain had become the world’s largest supplier of cryptocurrency mining rigs with a market share of 75%, according to Frost & Sullivan. And the Beijing-based company was preparing for a multibillion-dollar public listing in Hong Kong—until bitcoin crashed, losing 70% of its value by the end of that same year.

Bitmain’s IPO became a casualty of bitcoin’s volatility and placed a heavy strain on the company’s finances. And the two cofounders were quickly thrust into a scramble for survival that later evolved into a struggle for control of the company.

Today, Wu looks back at bitcoin’s twists and turns as milestones on his entrepreneurial journey toward building one of the world’s largest crypto business empires. Bitmain has since returned to profitability, according to Wu, and continues to dominate the global market for mining rigs from its headquarters in Beijing in spite of China’s recent crackdown on crypto mining and trading. In response to the new restrictions, the company ceased shipments to its clients in mainland China, although overseas customers are said to be unaffected. Bitmain is also building rigs that use less energy to address regulator’s concerns, but it did not elaborate on any further measures it intends to adopt.

Wu stepped away from Bitmain at the beginning of the year to focus on his role as chairman of two spinoffs which are both based in Singapore—Bitdeer Technologies, a cryptocurrency mining platform that’s already announced plans to list on the Nasdaq at a $4 billion valuation, and Matrixport, a financial services firm valued at $1 billion in its latest funding round.

Matrixport’s launch in February 2019 was another demonstration of Wu’s long-term optimism for the crypto industry. Bitcoin was still in a bear market when he and his fellow cofounder John Ge Yuesheng established their firm.

“We believed that crypto and blockchain together would experience rapid growth in the future to tens of trillions of dollars,” Wu says. “And many of these new users will stay in the crypto market forever, so they’ll need advanced and sophisticated products to manage the wealth they accumulate in crypto assets.”

Their decision to push ahead looks prescient now. Since Matrixport was launched, the overall market cap of cryptocurrencies shot up to an all-time high of $3 trillion in November, according to data from CoinGecko. And the global market size of crypto users has more than doubled to 221 million people in the first half of the year, according to a report from Crypto.com.

Cryptocurrencies have been riding high this year on signs that digital assets are becoming more mainstream. El Salvador became the first country in the world to accept bitcoin as legal tender and a growing number of companies including AMC, AT&T, Mastercard, Microsoft and PayPal and are now accepting some cryptocurrencies as payments.

I am Ryan Grandberry, I have done my bachelor’s in English literature, and further on I did my master’s in biotech. My most preferred genre of writing is health and biotech. I have been writing from the past 6 years about articles, web content, and blogs. In my career and education, I like to play along with work. I have also been a teacher in the past for 2 years.