The retail automation market is expected to be valued at USD 27.6 billion in 2024 and is projected to reach USD 44.3 billion by 2029; it is expected to grow at a CAGR of 9.9% during the forecast period according to a new report by MarketsandMarkets™.

The increasing demand rising demand for high-quality and fast service to consumers and the increasing adoption of integrated automated technology in warehouses are the key drivers fueling the expansion of the retail automation market.

Restraints such as regular maintenance and meeting regulatory compliance hinder market growth. However, factors such as increased transparency in supply chain management and enhanced retail experience for consumers by leveraging automation technologies provide lucrative opportunities for market players in coming years.

Based on product type retail automation market for POS systems is expected to hold the highest market share during the forecast period.

POS systems include interactive kiosks and self-checkout systems. Self-checkout systems in retail automation have witnessed rapid growth due to their ability to reduce checkout time, improve efficiency, and provide a seamless shopping experience for customers. Additionally, they offer cost savings for businesses by reducing the need for cashiers.

Retail automation market for the warehouse segment by implementation type to exhibit the highest market share during the forecast period.

Warehouse automation in retail has surged, employing technologies like robotics, automated storage, and picking systems, ensuring faster and more accurate order fulfillment while reducing labor costs and enhancing inventory management. This trend significantly improves supply chain efficiency and customer satisfaction, particularly in the retail industry.

Retail automation market for hypermarkets to hold high market share during the forecast period.

With automated systems handling checkout processes, inventory management, and restocking, hypermarkets can reduce labor costs and improve inventory accuracy.

This efficiency helps them compete more effectively with online retailers, offering competitive pricing and a wider range of products. Furthermore, automation allows hypermarkets to analyze customer purchasing patterns in real time, facilitating targeted marketing and optimized product placement.

Moreover, it enhances overall shopping experience by minimizing checkout times and reducing the risk of human errors, thus promoting customer satisfaction and loyalty.

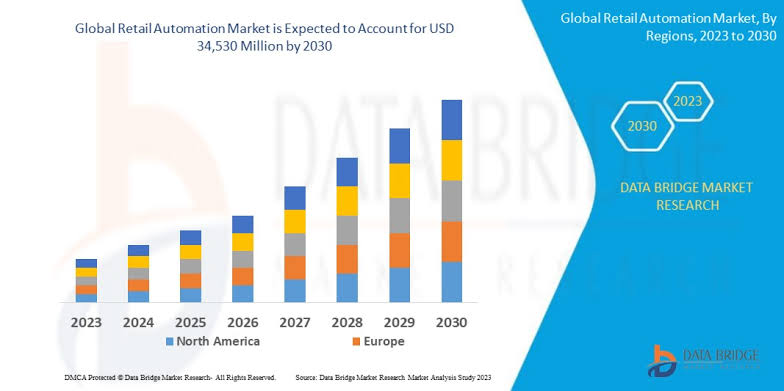

Retail Automation industry for Europe region to second hold the largest share during the forecast period.

In Europe, retail automation is experiencing significant growth due to several factors. The adoption of automation is particularly pronounced in the areas of checkout processes, inventory management, and customer service.

Increasing consumer demand for efficient and convenient shopping experiences has led retailers to invest in technologies like self-checkout kiosks, automated inventory management systems, and AI-driven recommendation engines. The widespread use of self-checkout kiosks, which not only reduce waiting times for customers but also help retailers save on labor costs.

Automated inventory management systems have become essential tools for retailers to optimize their supply chains, reducing wastage and ensuring that popular products are always in stock.

Key Players

The retail automation companies includes many major Tier I and II players like Honeywell International Inc. (US), NCR VOYIX Corporation. (US), Diebold Nixdorf, Incorporated. (US), Zebra Technologies Corp. (US), Hangzhou Hikvision Digital Technology Co., Ltd. (China), and others.

These players have a strong market presence in advanced packaging across various countries in North America, Europe, Asia Pacific, and the Rest of the World (RoW).

I am known as Fredrick Biggs I am a writer and an industrialist by profession. My age is 30 years. My aim is to gather the attention of the targeted audience without being boring and unexciting.

I like to utilize the free time in writing my views and thoughts for my book lovers or readers. My most preferred articles are usually about services sector and business; however, I have written various topics in my articles. I do not have a specific genre.